Over the past few months, several articles about Durham’s hectic housing market have made their way onto our feeds and into our inboxes. One such article from Triangle Business Journal (TBJ) explained the negative impact of corporate investment on prospective homeowners in the Triangle area. Analyzing sales data from the city of Raleigh in Q1 of 2021, TBJ found that 16.9% of homes were purchased by corporate buyers, trusts, Limited Liability Corporations (LLCs), and other real estate investment interests. Because investors are often able to pay in cash, they outcompete local prospective homebuyers, particularly those without access to substantial wealth.

DataWorks’ own quantitative research on property ownership trends corroborates the idea that corporate investment is making Durham less livable for both homeowners and renters. As part of our work under the Who Owns Durham project, we examined over 6,000 home sales transactions that occurred in Durham County between September of 2020 and late August of 2021.

In doing so, we found that corporate speculation is not only a growing problem, but one that undermines the accessibility of homeownership and increases precarity for renters. These impacts are heaviest in Durham’s historically Black neighborhoods. And while housing inequality has always been a crucial aspect of white supremacy, the “post-COVID land grab” may indicate a new order of operations for real estate profiteers.

What is a corporate investor?

For capitalists, real estate is understood to be one of the strongest investment opportunities. Housing reliably grows in value over time, allowing investors to park their money while their assets grow. Some speculators flip their properties quickly, while others opt to hang onto them for a while in order to extract rental income.

Since the foreclosure crisis of 2007, Durham has become a popular place for firms to run this money-making operation. The city has relatively low property prices and a steady influx of high-wage tech employees, creating demand for single family homes. Mirroring TBJ’s work in Raleigh, DataWorks found that 14.7% of Durham County residential properties sold between September of 2020 and August of 2021 were purchased by trusts, LLCs, limited partnerships, and other real estate investment interests. This marks a dramatic rise from 2000, when corporate investors only represented 3.8% of residential sales. If the trend continues, Durham’s corporate investment could be on track to meet other Sunbelt cities’ corporate investment rate of 25% or higher in the coming decades.

We frequently hear of gentrification and displacement resulting from a dramatic housing supply shortage in Durham. But our analysis suggests that the physical number of housing units might only be part of the equation. In fact, corporate investors are creating artificial scarcity, forcing people who are simply looking for a place to live to navigate a rugged world where exchange value (how much money can be made from selling a home) reigns supreme over use value (the quality of life one experiences by having a home). As our colleague, Tim Stallmann recently tweeted, increases in demand in both of these markets makes Durham less affordable.

The uneven geography of speculative investment

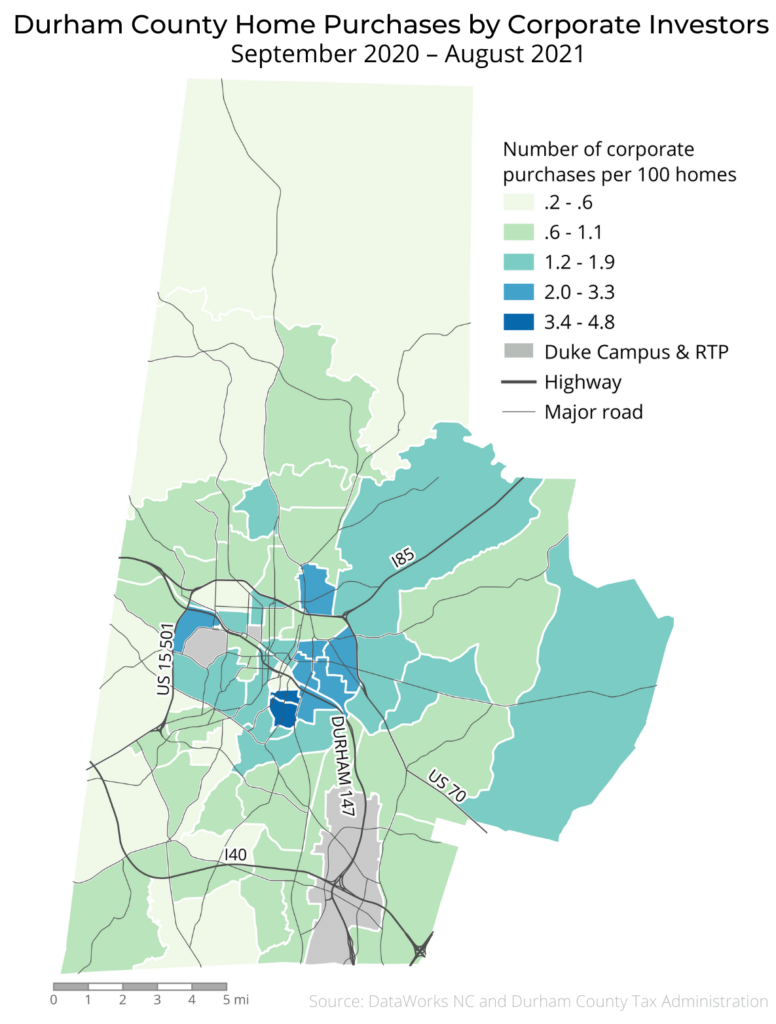

The fact that 15% of homes sold during our study period were purchased by corporate entities is itself staggering. However, these purchases (and their long-term impacts) are not evenly distributed across Durham County’s neighborhoods. In fact, historically Black communities like Old East Durham and the neighborhoods near North Carolina Central University are seeing the highest rates of corporate investment. This finding aligns with past research revealing that investors have pivoted their portfolio strategy to focus on low- and mid-priced single family homes, often purchasing large numbers of properties within a single zip code or neighborhood. In contrast, whiter communities with higher homeownership rates like Hope Valley and the wealthy subdivisions west of Highway 15-501 saw the lowest rates of corporate investment.

Corporate investment increases housing precarity

Corporate property hoarding in several of Durham’s historically Black neighborhoods reflects and reproduces systemic racism in our housing system. Most centrally, it is becoming functionally impossible for those without existing wealth to afford to buy a home in their own neighborhood. When entire populations are permanently forced to rent, not only are they prevented from building equity– they also become more vulnerable to displacement due to unaffordable rents, habitability issues, and other landlord whims. In fact, past DataWorks studies have proven a strong link between corporate real estate investment and growing eviction rates. Likewise, those who already own homes face untenably high property taxes, widespread home foreclosures, and the loss of multigenerational social ties.

Neighborhoods lead the way

Durham is indisputably gentrifying. Many of the problems mentioned above are already present, and they’re impossible to ignore no matter who you are or what neighborhood you live in. And while quantifying the mechanisms of gentrification can help us to combat it, the truth is that the people who are most impacted by these changes are experts when it comes to understanding the impacts on the ground. As we fight for a Durham with thriving neighborhoods, plentiful housing, and safe streets, it’s important to remember that lived experience is the most important form of expertise. We can’t stop the corporate colonization of our city overnight. But we can support our neighbors as they work to maintain the thriving communities they’ve already created and realize visions for a future where home is a place for connection and respite rather than investment.

Losing my place due to investment land grab profiteering. Looking for solidarity to fight these life destroyers. Strength in numbers. I’m 73 and being bullied out of my safe place for profit. I don’t pay enough rent💩