This is the time of year when many of Durham’s homeowners have recently paid their property taxes — taxes that have likely increased significantly since the home’s last valuation in 2016.

Why Property Values Change

By law local governments have to do property tax reappraisals no more than every 8 years. However, in recent years Durham has changed to make these assessments occur more frequently.

The 2016 reappraisal was the first to really reflect neighborhood changes that result from gentrification: escalating rents, increasing home sale prices, and dramatic investments that continue to influence property values.

Changes In the Cost of Property Over Time

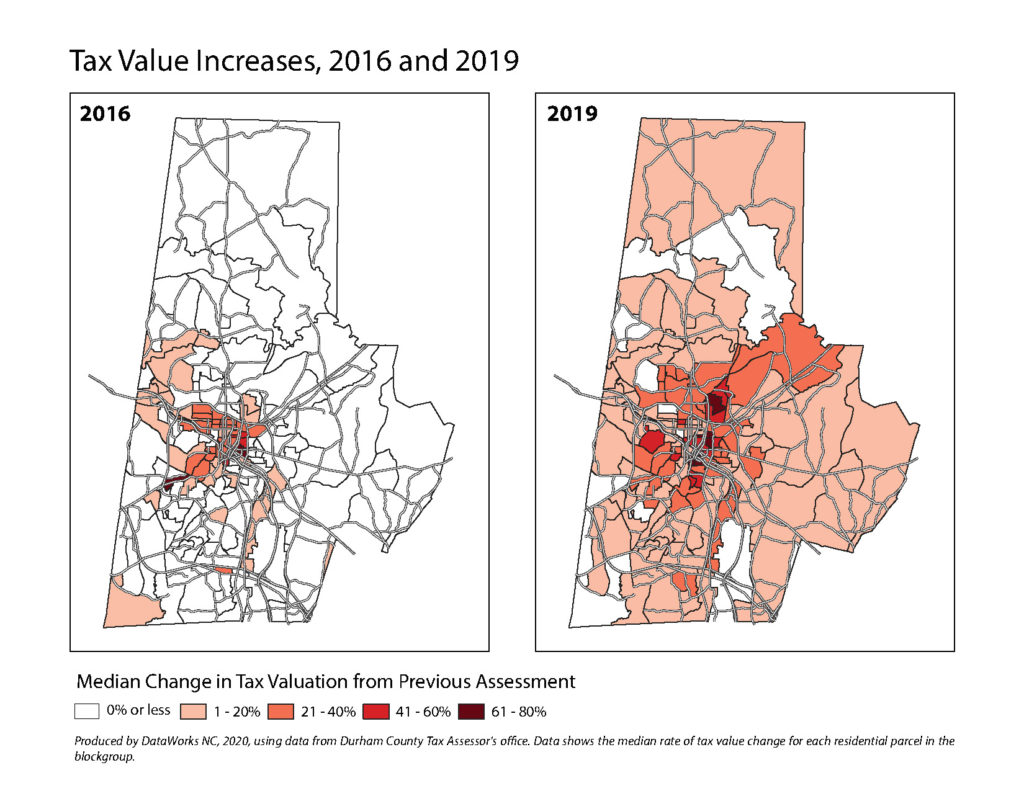

Across the county, market pressure has made land and buildings more expensive, and this gets captured in tax value increases. The maps below indicate the geographic impacts of the two most recent revaluations.

Not All Neighborhoods Share the Burden Equally

After the 2016 revaluation, a cluster of neighborhoods near downtown and Duke University saw the most substantial increases in property values. For example, the neighborhood that saw the highest rate of increase that year was Burch Avenue (132%), between West Chapel Hill Street, Duke University and Highway 147. Using the same scale as the 2016 map, the impact of the 2019 revaluation can be seen as a similarly dramatic change across much more of Durham County, and particularly in historically Black neighborhoods like Southside, Hayti, West End, Walltown and Braggtown.

What This Means About Your Tax Bill — or Your Neighbors’

These increases in residential property value across neighborhoods can make a major impact on low-income or fixed-income households. For every 100 dollars of assessed property value, a resident of the city will pay $1.2439 in combined City and County taxes. If you own a home valued at $100,000 and it is revalued at $150,000, your annual tax payment will increase from $1,244 to $1,865. In 2019, more than 3,900 residential properties increased in tax value by 100% or more.

50. When you call this crisis a housing crisis, you misunderstand the problem as one of production—the so-called “shortage”—and not of distribution. There are two vacant investor-owned homes for every houseless person in the country; cities overbuild luxury housing to appease investors, and the rents for working people do not decline despite that glut.

101 Notes on the LA Tenants Union

Beyond Measure

While you get a sense of sweeping neighborhood change in Durham, maps don’t tell the whole story, particularly the effect rising property taxes have on the lives of residents — on their health, jobs, schools, and their quality of life.

For many people who have low and fixed income, who receive Social Security Disability benefits, or who are financially burdened for any reason, paying higher property taxes can create a devastating burden — one that can’t wait for gradual, incremental change.

In Part 2 of this post, we’ll discuss the effects rising property taxes have on homeowners and renters and some efforts being made to alleviate their burdens.

Do you have data on the race of residents in the neighborhoods and census tracts with the increasing property values?